Budgeting 101: Building a Budget That Works For You

In an ideal world, budgeting means your bills are paid, you’re saving for emergencies, planning for future goals, and setting aside money for retirement. But in the real world, budgeting starts with understanding your current spending habits. That’s where we begin, by looking at your actual expenses and income.

Step 1: Gather Your Spending Information

Start by reviewing your past spending. You can use your checkbook, banking app, or online statements. This isn’t about judgment. It’s simply about gathering facts. You’re not making changes yet, just getting a clear picture of where your money goes.

Step 2: Sort Your Expenses into Three Categories

To make sense of your spending, divide your expenses into three types:

Fixed Expenses

These are regular payments that stay the same each month.

Examples:

- Rent or mortgage

- Car payment

- Insurance premiums

- Gym memberships

- Automatic savings deposits

Periodic Expenses

These are expected costs that don’t happen every month.

Examples:

- Car registration

- Quarterly subscriptions

- Annual memberships (like AAA or warehouse clubs)

Variable Expenses

These change from month to month.

Examples:

- Groceries

- Gas

- Dining out

- Entertainment

Note: Some items may appear in more than one category depending on how you pay for them. That’s okay! Just choose the category that fits your situation best.

Step 3: Input Your Numbers

Use the budgeting tool to enter your expenses. This tool is completely private and only you can see your data. Feel free to adjust the categories to match your lifestyle.

What Will My Budget Look Like?

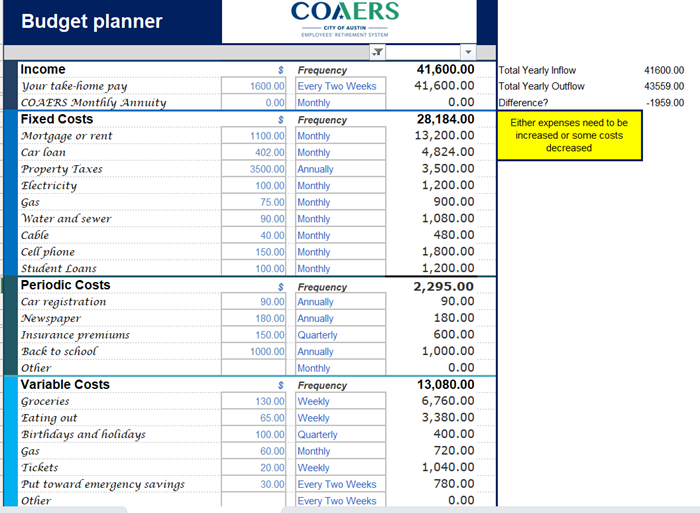

Here’s an example:

A sample household spends more than it earns, by about $1,959 per year. That means they’ll need to either increase their income or reduce spending by that amount.

If this were your budget, what changes could you make? Try listing five possible adjustments, big or small, that could help close the gap.

Step 4: Review and Reflect

Once you’ve entered your data, take a moment to review it. Are you saving anything? Are you relying on credit or borrowing to make ends meet? This is your starting point. From here, you can begin making informed decisions to improve your financial health. Understanding your spending habits is the first critical step toward effective budgeting toward YOUR goals.

Disclaimer

This page offers educational content and links to nonprofit and public service websites selected to support the financial wellbeing of COAERS members. These resources are provided for informational purposes only. COAERS does not endorse or guarantee the accuracy, security, or services of any external site. We encourage users to exercise discretion when accessing third-party content. Resources have been curated in accordance with COAERS’ Social Media policy and exclude for-profit entities, political organizations, labor groups, and individuals or organizations soliciting donations.